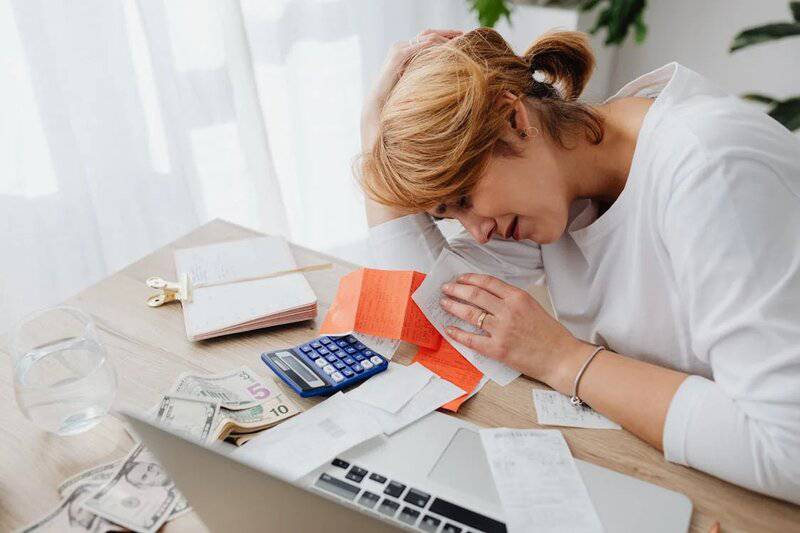

It’s a common trap: as your income rises, so do your spending habits. Lifestyle inflation happens when bigger paychecks lead to upgraded cars, fancier homes, and pricier vacations—without growing your savings. While it’s tempting to reward yourself, modest living can actually propel you ahead financially. Meanwhile, those who feel compelled to keep up with peers often find themselves stuck, never accumulating real wealth. Over time, these small upgrades add up, making it harder to invest or build a safety net. Instead of moving forward, you’re just spinning your wheels—watching your bank account stagnate while expenses rise.